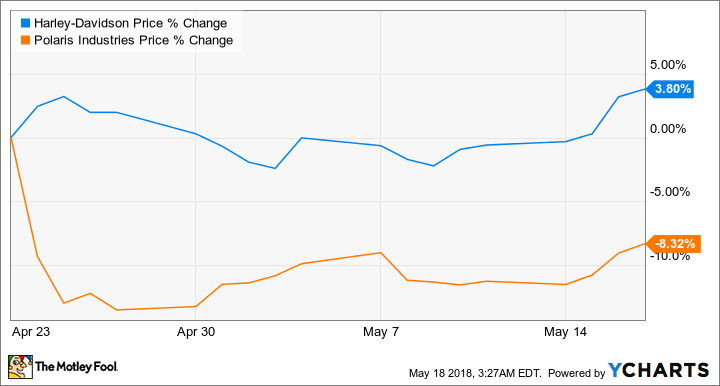

One of the best reasons that investing experts give to explain why you shouldn't short stocks is that the market can remain irrational longer than you can remain solvent. For proof of that irrationality, you need look no further than Harley-Davidson (NYSE:HOG) and Polaris Industries (NYSE:PII).

In the weeks since both companies reported first-quarter earnings near the end of April, Harley-Davidson's stock price has gained almost 4%, while Polaris shares tumbled as much as 13%. But it was Polaris that reported solid numbers, while Harley's report was yet another disaster.

HOG data by YCharts

Happy days are here againBeyond management's happy talk, it's hard to make out a reason why investors aren't punishing Harley Davidson stock. Despite U.S. sales continuing their sickening slide -- down 12% year over year -- CEO Matt Levatich says his team is cobbling together a strategy that'll turn things around. What that strategy will be, we don't know, but, boy, it's going to be awesome!

It'll have to be for Harley to hit its goal of bringing in 2 million new U.S. riders over the next 10 years, delivering 100 new bike models in that time frame, and increasing its international volumes so that foreign markets account for half of all�Harley Davidson bikes sold.

Polaris, on the other hand, reported continued strong demand for its Indian Motorcycle brand with wholegood sales rising by double-digit percentages, and retail demand climbing by low single-digit percentages. Moreover, sales of off-road vehicles (ORVs) were exceptionally strong, with shipments for its Ranger, RZR, and ATVs driving wholegoods sales 17% higher.

Image source: Polaris Industries.

Because Polaris has had to issue a seemingly endless string of recalls of its ORVs due to fire hazards, the fact that its lineup is still holding its own and leading the industry in sales is remarkable.

And where Harley has essentially told investors, "trust us, we'll turn things around," Polaris gave specifics, raised the low end of its full-year guidance, and said it expects sales to grow 4% to 6% over 2017.

Hitting the brakesWhile Polaris provided some solid numbers for investors to sink their teeth into compared to the feel-good sentiments of its rival, bearish investors may have been reacting to the implication that its sales will slow for the rest of the year.

Because overall Q1 sales came in 12% higher than a year ago, guidance pointing to full-year growth of just half of that -- or worse -- suggests Polaris expects to run into some headwinds. Also, the midpoint of the earnings-per-share guidance range come in at $6.12, -- $0.05 per share below the Wall Street consensus.

Even so, that's still better than Harley's guidance. While the big bike maker doesn't issue sales or earnings guidance, it did say it expects shipments of motorcycles to be down 2% to 4% from last year. It bases that on the steep 15% drop in Q1 and an expected 11% to 14% decline in Q2 -- after which it asserts sales will boomerang, and shoot 12% higher in the second half.

Shipments aren't sales, and fluctuations in that statistic can have more to do with maintaining dealer inventory -- but if its bikes aren't moving off the showroom floors, it's going to have a hard time adding even more.

Image source: Harley-Davidson.

Good for the goose, not the ganderThe market seems to be making a judgment based on the hard numbers Polaris Industries has posted compared to the vague but optimistic talk from Harley-Davidson. Also worth considering: Shares of Polaris trade at 30 times trailing earnings, while Harley's P/E is half of that-- but an argument can be made that Polaris' better business prospects justify the premium it is being accorded.

On one metric, though, Harley-Davidson looks exceptionally cheap: It trades at less than 10 times its free cash flow -- a bargain valuation or a sign that things could still get worse.

By contrast, considering Polaris Industries' diversified revenue streams and the outlook for growth in its various segments, there's no reason its stock should have received the drubbing it has while Harley-Davidson's shares emerged from the past few weeks unscathed. It does suggest the market remains as illogical as ever.

No comments:

Post a Comment