It would be hard to find a podcast-hosting duo more totally invested in answering your financial questions than Alison Southwick and Robert Brokamp -- they put "Answers" in the show's name, for goodness' sake! And this week, they're at it again, combing through the Motley Fool Answers mailbag in search of conundrums to address for their listeners. But because three heads are better than two, for this episode, they've enlisted the help of Sean Gates, a financial planner with Motley Fool Wealth Management.

In this segment, they address the concerns of a listener who is looking for a financial advisor that he can trust is offering personalized advice that's in his best interests -- as opposed to generic advice designed to profit the advisor. Where should he go to find a financial planner worth the money? Sean, in particular, has some thoughts.

Sean Gates is an employee of Motley Fool Wealth Management, a separate, sister company of The Motley Fool, LLC. The views of Sean Gates and Motley Fool Wealth Management are not the views of The Motley Fool, LLC and should not be taken as such.

A full transcript follows the video.

This video was recorded on June 26, 2018.

Alison Southwick: Next question comes to us from Bruce. "I have been interviewing fee-based advisors, but I find their business model unconscionable. For instance, I can invest $100,000 with a fee-based advisor and they fee me 1% of the portfolio value -- so, they charge me $1,000 a year, get personal information about me like tax info, risk tolerance, retirement goals, hobbies, pet names, kids' names, and other seemingly non-relevant financial information.

"They invest our money in their recommended funds and introduce me to their estate law and tax advisors, who I would pay extra to sit with. Then, they offered to meet with me and the wife three or four times a year. The first 15 minutes is to get caught up on the kids, travel and grandchildren, and then the next 15 minutes, they tell me the situation about our portfolio, which they don't really manage, they just use another company to advise them on where to put our money." Man, listeners are getting the inside scoop with this! We're not done yet, Bruce has more.

"They invite us to events with their chosen speakers and give us something to eat, and they are real friendly. Here's the rub: my neighbor invests $2 million, and they get exactly the same treatment, but they pay $20,000 a year. Why does the Department of Labor consider this fair value? Where are the honest IRAs who only charge for checkup meetings or special meetings aimed at discussing new circumstances? Why can't I pay a couple of hundred dollars for their expert advice when I need it?"

Robert Brokamp: A lot there from Bruce.

Southwick: Bruce does not want your chosen speakers and snacks! He wants advice, good advice at a fair price!

Brokamp: [laughs] He also doesn't want to talk about his travel.

Southwick: [laughs] No!

Sean Gates: I don't care about your kids, Bruce!

Southwick: I love it! I feel like I'm sitting there in the room with him, across the desk, and he's just like, "The kids are fine, let's get to it." Alright, here we go, from the sister company of The Motley Fool -- is he right in what he's saying?

Gates: In part, yeah, he is. This is tough, because you have to know a lot of the stuff that you think is non-relevant financial information to give good advice.

Brokamp: That was my first reaction looking at that. A lot of that information is actually really important.

Gates: It's super important. I know it doesn't seem like it, but those questions help us ask questions that you're not thinking to ask. It's tough.

But, to your point, if it's true that they're charging you 1% and you're not seeing value from it -- meaning, the growth of your portfolio isn't overcoming that fee, or isn't doing better than the S&P 500, then yeah, you're probably in the wrong situation. There are model portfolios and investment managers who can out-perform the S&P 500. It's difficult, but they exist, so don't discount all of them for that.

Then, the other key thing that I would mention is, there are actually a lot of studies that are coming out that show that the value of financial planning advice is worth some amount of investment return. Now, different reports have different values, but it ranges between 1.75-3.5%. That's not insignificant. If you compound that over time, that's a huge amount of value creation potential that's there. I see a lot of bad raps for 1% advisors. If you have a $1 million portfolio, that's $10,000 a year, that seems like an enormous amount of money. But I feel like I've been able to provide well over that amount in fee to them in advice. And if I can't, I'll tell them.

Brokamp: And there are advisors who charge a flat fee or charge by the hour, but those are just one-time, two-time, three-time engagements. It's not ongoing advice. For someone who's mostly a do-it-yourselfer or someone who wants to be very involved in the process and very hands-on, I love it. I think it's great. But if you want to go with someone who's doing more of the ongoing management, it's a different type of story.

I would say, Bruce is obviously meeting with people who are not convincing him of the value. He would have to pay extra for tax help, for example. You should expect a little bit of tax guidance, even a little bit of estate planning guidance, from a financial advisor. Not a complete estate plan, that should be done by an attorney. But you should get at least some guidance from your financial advisor. If Bruce is not meeting with people who are convincing him that they're providing enough service, then he should keep looking, I think, because they're out there.

Gates: Definitely. I think part of Bruce's problem and everyone's problem is, there's a whole industry of people who want to help you for an innumerable amount of different charge methodologies. There's hourly, there's fee-based, there's commission-based. It's really hard as a consumer to figure out who's honest. I don't know that I have good advice other than look for a reputable company.

Brokamp: Bruce also brought up the Department of Labor. I'll just point out that the Department of Labor does have jurisdiction over things like employer plans and things like that. Flat-out financial advisors is more of an SEC type of thing, and FINRA.

Southwick: It sounds like his concern is that it's a flat percent no matter how much money you have. His neighbor is paying $20,000 a year, he's paying $1,000 a year, and they're getting the same level of service. Is that true? Are they?

Brokamp: I think there's a lot of truth to that, for sure. On the other hand, there's also, someone who does have more money, does tend to have more complicated finances.

Gates: Not only do they tend to have more complicated finances, but the value creation from financial planning escalates the more money you have. A particular tax saving strategy for someone who has $20 million, if you're paying me $20,000 as a 1% fee, I might save you $200,000 in taxes. The benefit scales with the amount of money that you have. So, in effect, the value that they're getting is higher than the value that you're getting, even though the fee is the same on an apples-to-apples comparison.

Then, you may be extrapolating incorrectly. A lot of fee schedules have breakpoints. If you have $0-500,000, you're charged 1%. If you have $500,000 to $1 million, you're charged 0.75%. It goes down the more wealth that you have.

Brokamp: In fact, I would say that's standard.

Gates: That's fairly common, yeah. That's just something to consider, as well.

Wagner Bowman Management Corp boosted its stake in shares of Vanguard Total Stock Market ETF (NYSEARCA:VTI) by 0.8% during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm owned 128,305 shares of the company’s stock after buying an additional 1,022 shares during the period. Vanguard Total Stock Market ETF makes up approximately 4.7% of Wagner Bowman Management Corp’s holdings, making the stock its 2nd largest holding. Wagner Bowman Management Corp’s holdings in Vanguard Total Stock Market ETF were worth $18,017,000 at the end of the most recent reporting period.

Wagner Bowman Management Corp boosted its stake in shares of Vanguard Total Stock Market ETF (NYSEARCA:VTI) by 0.8% during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm owned 128,305 shares of the company’s stock after buying an additional 1,022 shares during the period. Vanguard Total Stock Market ETF makes up approximately 4.7% of Wagner Bowman Management Corp’s holdings, making the stock its 2nd largest holding. Wagner Bowman Management Corp’s holdings in Vanguard Total Stock Market ETF were worth $18,017,000 at the end of the most recent reporting period.  Source: Richard Stephenson via Flickr (Modified)

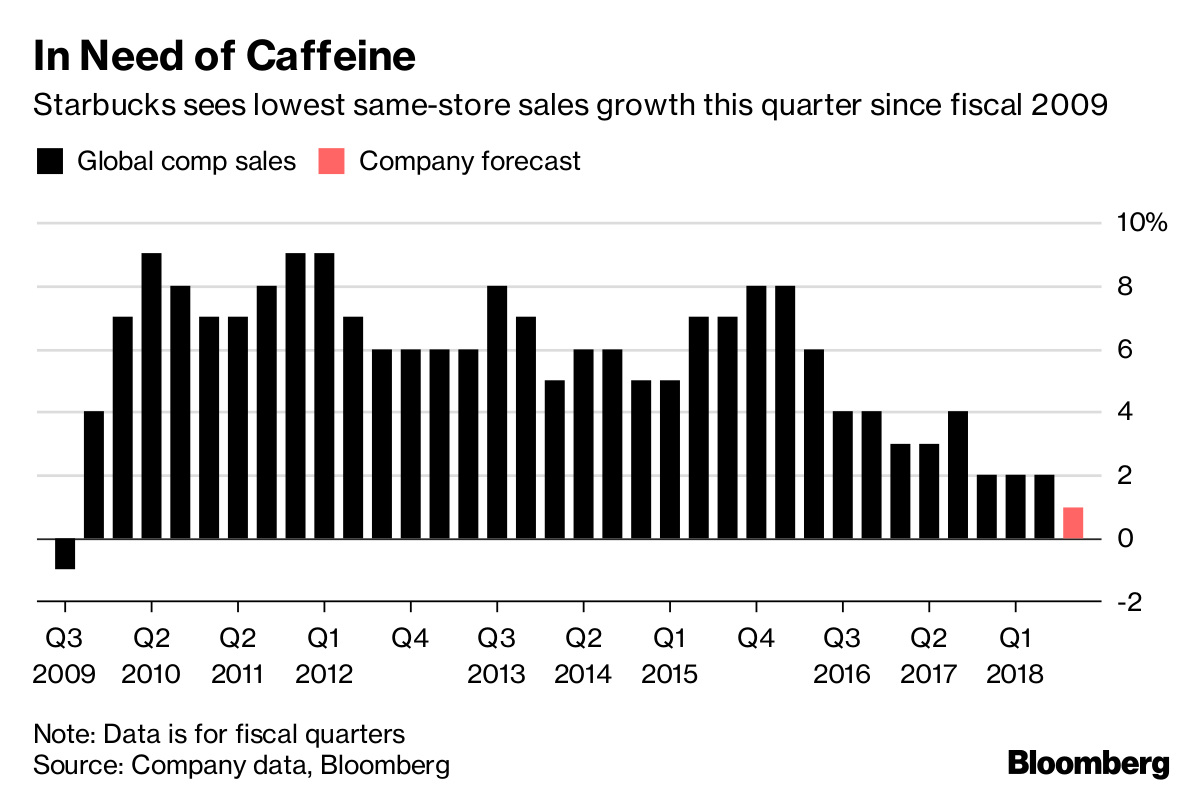

Source: Richard Stephenson via Flickr (Modified)  News coverage about Starbucks (NASDAQ:SBUX) has been trending somewhat negative on Thursday, Accern Sentiment Analysis reports. Accern identifies positive and negative news coverage by monitoring more than twenty million blog and news sources in real-time. Accern ranks coverage of companies on a scale of negative one to positive one, with scores nearest to one being the most favorable. Starbucks earned a news sentiment score of -0.01 on Accern’s scale. Accern also assigned headlines about the coffee company an impact score of 48.2586100826577 out of 100, meaning that recent news coverage is somewhat unlikely to have an effect on the company’s share price in the next several days.

News coverage about Starbucks (NASDAQ:SBUX) has been trending somewhat negative on Thursday, Accern Sentiment Analysis reports. Accern identifies positive and negative news coverage by monitoring more than twenty million blog and news sources in real-time. Accern ranks coverage of companies on a scale of negative one to positive one, with scores nearest to one being the most favorable. Starbucks earned a news sentiment score of -0.01 on Accern’s scale. Accern also assigned headlines about the coffee company an impact score of 48.2586100826577 out of 100, meaning that recent news coverage is somewhat unlikely to have an effect on the company’s share price in the next several days.  Shares of GDS Holdings Ltd – (NASDAQ:GDS) have received a consensus rating of “Buy” from the seven analysts that are covering the firm, MarketBeat.com reports. One research analyst has rated the stock with a sell rating, one has given a hold rating and four have issued a buy rating on the company. The average 1 year price target among brokerages that have covered the stock in the last year is $42.00.

Shares of GDS Holdings Ltd – (NASDAQ:GDS) have received a consensus rating of “Buy” from the seven analysts that are covering the firm, MarketBeat.com reports. One research analyst has rated the stock with a sell rating, one has given a hold rating and four have issued a buy rating on the company. The average 1 year price target among brokerages that have covered the stock in the last year is $42.00.  Analysts predict that Waters Co. (NYSE:WAT) will post earnings per share of $1.92 for the current quarter, Zacks Investment Research reports. Seven analysts have made estimates for Waters’ earnings, with the highest EPS estimate coming in at $2.00 and the lowest estimate coming in at $1.87. Waters reported earnings of $1.76 per share during the same quarter last year, which would suggest a positive year over year growth rate of 9.1%. The firm is scheduled to issue its next earnings results on Tuesday, July 24th.

Analysts predict that Waters Co. (NYSE:WAT) will post earnings per share of $1.92 for the current quarter, Zacks Investment Research reports. Seven analysts have made estimates for Waters’ earnings, with the highest EPS estimate coming in at $2.00 and the lowest estimate coming in at $1.87. Waters reported earnings of $1.76 per share during the same quarter last year, which would suggest a positive year over year growth rate of 9.1%. The firm is scheduled to issue its next earnings results on Tuesday, July 24th.

Schultz (L) hands Johnson the key to the original Starbucks store during the annual shareholders’ meeting on March 22, 2017 in Seattle.Photographer: Stephen Brashear/Getty Images

Schultz (L) hands Johnson the key to the original Starbucks store during the annual shareholders’ meeting on March 22, 2017 in Seattle.Photographer: Stephen Brashear/Getty Images  Oppenheimer Asset Management Inc. reduced its stake in Extra Space Storage (NYSE:EXR) by 10.3% in the first quarter, HoldingsChannel.com reports. The fund owned 13,051 shares of the real estate investment trust’s stock after selling 1,502 shares during the period. Oppenheimer Asset Management Inc.’s holdings in Extra Space Storage were worth $1,140,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Oppenheimer Asset Management Inc. reduced its stake in Extra Space Storage (NYSE:EXR) by 10.3% in the first quarter, HoldingsChannel.com reports. The fund owned 13,051 shares of the real estate investment trust’s stock after selling 1,502 shares during the period. Oppenheimer Asset Management Inc.’s holdings in Extra Space Storage were worth $1,140,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Franklin Resources Inc. boosted its holdings in Mattel (NASDAQ:MAT) by 729.2% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 25,812,527 shares of the company’s stock after buying an additional 22,699,590 shares during the period. Franklin Resources Inc. owned 7.50% of Mattel worth $339,438,000 as of its most recent SEC filing.

Franklin Resources Inc. boosted its holdings in Mattel (NASDAQ:MAT) by 729.2% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 25,812,527 shares of the company’s stock after buying an additional 22,699,590 shares during the period. Franklin Resources Inc. owned 7.50% of Mattel worth $339,438,000 as of its most recent SEC filing.  Equities research analysts expect Cohu, Inc. (NASDAQ:COHU) to report $0.42 earnings per share for the current quarter, according to Zacks. Two analysts have made estimates for Cohu’s earnings, with the highest EPS estimate coming in at $0.48 and the lowest estimate coming in at $0.32. Cohu reported earnings per share of $0.48 during the same quarter last year, which suggests a negative year over year growth rate of 12.5%. The business is scheduled to issue its next quarterly earnings results on Thursday, July 26th.

Equities research analysts expect Cohu, Inc. (NASDAQ:COHU) to report $0.42 earnings per share for the current quarter, according to Zacks. Two analysts have made estimates for Cohu’s earnings, with the highest EPS estimate coming in at $0.48 and the lowest estimate coming in at $0.32. Cohu reported earnings per share of $0.48 during the same quarter last year, which suggests a negative year over year growth rate of 12.5%. The business is scheduled to issue its next quarterly earnings results on Thursday, July 26th.