Rockefeller Capital Management L.P. bought a new stake in EOG Resources Inc (NYSE:EOG) in the 1st quarter, HoldingsChannel.com reports. The firm bought 525,689 shares of the energy exploration company’s stock, valued at approximately $55,338,000.

Rockefeller Capital Management L.P. bought a new stake in EOG Resources Inc (NYSE:EOG) in the 1st quarter, HoldingsChannel.com reports. The firm bought 525,689 shares of the energy exploration company’s stock, valued at approximately $55,338,000.

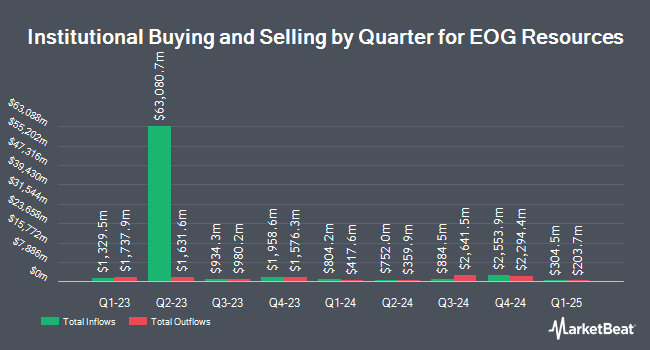

A number of other large investors have also recently modified their holdings of the stock. Silvant Capital Management LLC acquired a new stake in EOG Resources during the first quarter worth approximately $8,719,000. Swedbank acquired a new stake in EOG Resources during the first quarter worth approximately $127,489,000. Usca Ria LLC lifted its position in EOG Resources by 222.0% during the first quarter. Usca Ria LLC now owns 35,775 shares of the energy exploration company’s stock worth $3,766,000 after acquiring an additional 24,666 shares during the last quarter. Exencial Wealth Advisors LLC lifted its position in EOG Resources by 2.4% during the first quarter. Exencial Wealth Advisors LLC now owns 46,671 shares of the energy exploration company’s stock worth $4,913,000 after acquiring an additional 1,093 shares during the last quarter. Finally, King Luther Capital Management Corp lifted its position in EOG Resources by 1.8% during the first quarter. King Luther Capital Management Corp now owns 1,734,229 shares of the energy exploration company’s stock worth $182,562,000 after acquiring an additional 30,162 shares during the last quarter. Institutional investors and hedge funds own 85.43% of the company’s stock.

Get EOG Resources alerts:

EOG has been the subject of several research reports. Stifel Nicolaus set a $146.00 price objective on shares of EOG Resources and gave the stock a “buy” rating in a research report on Monday, April 23rd. UBS initiated coverage on shares of EOG Resources in a research report on Wednesday, March 7th. They set a “buy” rating and a $125.00 price objective for the company. Piper Jaffray set a $122.00 price objective on shares of EOG Resources and gave the stock a “buy” rating in a research report on Wednesday, March 14th. Jefferies Group set a $111.00 price objective on shares of EOG Resources and gave the stock a “hold” rating in a research report on Thursday, March 8th. Finally, Tudor Pickering downgraded shares of EOG Resources from a “buy” rating to a “hold” rating in a research report on Thursday, May 10th. One analyst has rated the stock with a sell rating, eight have assigned a hold rating and fifteen have issued a buy rating to the company. The stock has a consensus rating of “Buy” and an average price target of $122.57.

Shares of EOG Resources opened at $125.79 on Friday, according to Marketbeat. EOG Resources Inc has a 12 month low of $81.99 and a 12 month high of $126.48. The company has a market cap of $72.81 billion, a PE ratio of 112.31, a price-to-earnings-growth ratio of 3.43 and a beta of 1.05. The company has a current ratio of 1.26, a quick ratio of 1.06 and a debt-to-equity ratio of 0.36.

EOG Resources (NYSE:EOG) last announced its earnings results on Thursday, May 3rd. The energy exploration company reported $1.19 EPS for the quarter, topping the Thomson Reuters’ consensus estimate of $0.80 by $0.39. The company had revenue of $3.68 billion for the quarter, compared to analysts’ expectations of $3.51 billion. EOG Resources had a net margin of 26.00% and a return on equity of 8.19%. The business’s revenue for the quarter was up 41.0% on a year-over-year basis. During the same period last year, the firm earned $0.15 earnings per share. equities analysts predict that EOG Resources Inc will post 4.8 EPS for the current year.

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 31st. Investors of record on Saturday, July 7th will be paid a $0.185 dividend. The ex-dividend date of this dividend is Monday, July 16th. This represents a $0.74 dividend on an annualized basis and a yield of 0.59%. EOG Resources’s dividend payout ratio (DPR) is 66.07%.

In related news, President Gary L. Thomas sold 50,000 shares of EOG Resources stock in a transaction that occurred on Thursday, May 17th. The shares were sold at an average price of $125.36, for a total value of $6,268,000.00. Following the transaction, the president now directly owns 988,947 shares of the company’s stock, valued at $123,974,395.92. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CAO Ann D. Janssen sold 1,258 shares of EOG Resources stock in a transaction that occurred on Thursday, May 17th. The shares were sold at an average price of $126.35, for a total transaction of $158,948.30. Following the completion of the transaction, the chief accounting officer now directly owns 53,828 shares in the company, valued at $6,801,167.80. The disclosure for this sale can be found here. Insiders sold 67,453 shares of company stock worth $8,423,028 over the last three months. 0.51% of the stock is currently owned by insiders.

About EOG Resources

EOG Resources, Inc, together with its subsidiaries, explores for, develops, produces, and markets crude oil and natural gas. The company's principal producing areas are located in New Mexico, North Dakota, Texas, Utah, and Wyoming in the United States; and the Republic of Trinidad and Tobago, the United Kingdom, the People's Republic of China, and Canada.

Want to see what other hedge funds are holding EOG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for EOG Resources Inc (NYSE:EOG).

Franklin Resources Inc. boosted its holdings in Mattel (NASDAQ:MAT) by 729.2% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 25,812,527 shares of the company’s stock after buying an additional 22,699,590 shares during the period. Franklin Resources Inc. owned 7.50% of Mattel worth $339,438,000 as of its most recent SEC filing.

Franklin Resources Inc. boosted its holdings in Mattel (NASDAQ:MAT) by 729.2% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 25,812,527 shares of the company’s stock after buying an additional 22,699,590 shares during the period. Franklin Resources Inc. owned 7.50% of Mattel worth $339,438,000 as of its most recent SEC filing.  Equities research analysts expect Cohu, Inc. (NASDAQ:COHU) to report $0.42 earnings per share for the current quarter, according to Zacks. Two analysts have made estimates for Cohu’s earnings, with the highest EPS estimate coming in at $0.48 and the lowest estimate coming in at $0.32. Cohu reported earnings per share of $0.48 during the same quarter last year, which suggests a negative year over year growth rate of 12.5%. The business is scheduled to issue its next quarterly earnings results on Thursday, July 26th.

Equities research analysts expect Cohu, Inc. (NASDAQ:COHU) to report $0.42 earnings per share for the current quarter, according to Zacks. Two analysts have made estimates for Cohu’s earnings, with the highest EPS estimate coming in at $0.48 and the lowest estimate coming in at $0.32. Cohu reported earnings per share of $0.48 during the same quarter last year, which suggests a negative year over year growth rate of 12.5%. The business is scheduled to issue its next quarterly earnings results on Thursday, July 26th. Norsk Hydro (OTCMKTS:NHYDY) has earned a consensus recommendation of “Hold” from the eight brokerages that are presently covering the company, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and three have assigned a buy rating to the company.

Norsk Hydro (OTCMKTS:NHYDY) has earned a consensus recommendation of “Hold” from the eight brokerages that are presently covering the company, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and three have assigned a buy rating to the company. Rockefeller Capital Management L.P. bought a new stake in EOG Resources Inc (NYSE:EOG) in the 1st quarter, HoldingsChannel.com reports. The firm bought 525,689 shares of the energy exploration company’s stock, valued at approximately $55,338,000.

Rockefeller Capital Management L.P. bought a new stake in EOG Resources Inc (NYSE:EOG) in the 1st quarter, HoldingsChannel.com reports. The firm bought 525,689 shares of the energy exploration company’s stock, valued at approximately $55,338,000.