Top 5 Gold Stocks To Watch Right Now

Related CALD Benzinga's Top Initiations UPDATE: Credit Suisse Initiates Coverage on Callidus Software

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Cloud software provider Callidus (NASDAQ: CALD) is in the Danger Zone this week. We’ve recently highlighted two other Software as a Service (SaaS) companies in Netsuite (NYSE: N) andSalesforce.com (NYSE: CRM), and CALD is a classic story of a bad company riding the coattail of the popularity of cloud computing and SaaS companies. SaaS stocks surged in 2013, and CALD followed the trend, gaining 166% over the past year.

Compared to its competitors, CALD has less scale, inferior profitability metrics, and fishy accounting to boot. The stock’s valuation is so high that our DCF model can hardly make sense of it. The stock seems to be trading largely on the hopes of an acquisition.

Poor Profitability

CALD has never earned a profit, nor has it ever even come close. 2008 was its best year, when it earned over $100 million in revenue and had profit (NOPAT) margins of -11%. In terms of return on invested capital (ROIC), CALD’s best year was 2011, when it was -25%. In its most profitable year of operation, CALD lost 25 cents for every dollar invested.

CALD looks bad on a cash flow basis as well. The company has had negative free cash flow in five out of the past six years, and it has burned through roughly $75 million in the past two years. CALD has reported positive cash flows in 2013, but that’s due to the $17.5 million in deferred revenue at year-end, a fourfold increase from the year before.

CALD started 2013 with $67 million in adjusted total debt. It managed to reduce that debt by $31 million in 2013 by issuing another 4 million shares, further diluting its stock. The fact that CALD had to resort to issuing further shares to pay back its debt should concern investors. The positive cash flow from deferred revenues is only a short-term patch on what appears to be a very leaky business.

Fishy Accounting

CALD employs multiple accounting tricks to give the illusion of profitability.

Like many unprofitable companies, CALD likes to highlight its “non-GAAP” results, which exclude items like stock-based compensation, restructuring expense, and other non-cash or non-recurring expenses. While I am in support of using non-GAAP measures to analyze profitability (our NOPAT metric makes several adjustments to GAAP net income) investors should be very wary of non-GAAP measures provided by companies. Typically, when companies make up their own profit metrics, they tend to find ways to boost profitability.

CALD uses two main techniques to boost its “non-GAAP” earnings. The first, stock-based compensation, is a widespread practice, especially in the tech industry. While GAAP rules changed to require companies to include stock-based compensation expense in 2005, many companies like CALD continue to exclude stock-based compensation in non-GAAP results. Excluding stock-based compensation expense allowed CALD to boost non-GAAP income by $13.7 million (14% of revenue) in 2012 and $10.4 million (9% of revenue) in 2013. All these outstanding employee stock options constitute a $25 million (6% of market cap) liability for CALD.

The other, more unusual technique CALD employs involves restructuring expense. CALD has incurred restructuring expenses in each of the past seven years with an average expense of $1.6 million a year. According to its filings, CALD has been undergoing restructuring for more than half of its life as a publicly traded company. This typically ‘unusual’ charge for CALD has become usual. Perhaps, they like classifying expenses as “restructuring” because they exclude those costs from their “non-GAAP” income metric.

The surge in CALD’s stock price last year came in part from its return to “non-GAAP” profitability in 2013. CALD reported a “non-GAAP” profit of $1.8 million, most of which is made up of the $1.7 million in restructuring expenses that the “non-GAAP” metric excludes. CALD might classify these expenses as “non-recurring”, but their history suggests otherwise.

Competitive Position

While we’ve compared CALD’s profitability to CRM and N, it actually has set itself up to avoid direct competition with those firms as much as possible. Its Learning, Hiring, Marketing, and Selling clouds aim to fill in the gaps between the enterprise resource planning and customer relationship management solutions marketed by larger companies.

Unfortunately for CALD, it’s not the only company filing those gaps. Numerous small companies compete with CALD as does Oracle (NYSE: ORCL). In fact, ORCL is making a big push into the cloud software space and it seems to view CALD as a less formidable adversary than CRM or N.

Obviously, ORCL has a massive scale advantage over CALD. ORCL spent almost $5 billion on research and development in 2013 while CALD spent just $17 million. Of course ORCL is not spending its entire R&D budget on cloud products, but there’s no question it can outspend CALD by a huge amount.

We’re seeing a growing level of commoditization in the software industry, and CALD looks like a prime candidate to fall victim to this trend. As more firms try to occupy its niche, CALD will struggle to differentiate its product, and it should have real trouble competing with a firm like ORCL on price.

Valuation in the Clouds

CALD pulled back over 20% at the end of last week due to lower guidance, but it remains significantly overvalued. If we assume CALD can achieve profitability next year and reach 20% pre-tax margins by 2019 (same level as IBM), it would still have togrow revenue by 8% compounded annually for 25 years to justify its valuation of ~$11.50/share.

Both the margin assumptions and the revenue growth horizon seem overly optimistic to me. CALD faces too much competition going forward to assume 20% margins, while 25 years is too long of a growth appreciation period for a company in a rapidly changing industry like cloud software.

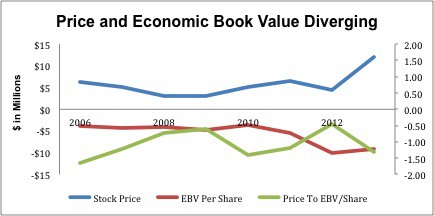

Figure 1 shows how CALD’s stock price and profitability have reached an unprecedented level of divergence recently.

Figure 1: Stock Price vs Economic Book Value (Zero Growth Value)

Sources: New Constructs, LLC and company filings

Despite the 20% drop, CALD is still near its all-time high, while economic book value is near its all time low. There has never been a worse time to buy.

Insider Selling Signals a Top

The recent decline is not just a blip for CALD, it’s the start of a long-term downtrend. A look at the insider trading activity for CALD bears out this thesis. Over the past six months, insiders have sold over 200 thousand shares, about 12% of their holdings. Such a large amount of selling does not signal strong confidence in the company’s future.

Shorting a high momentum stock is always a dangerous proposition, but the recent reversal of momentum makes CALD an appealing short candidate. Any further slowdown in revenue growth or profitability, or success from competitors like ORCL, could send the stock tanking.

The only possibility for price appreciation at this point seems to be an acquisition. Rumors have been spreading that CALD could be an acquisition target, but no offers have been made as of yet. I don’t see any company wanting to give CALD much of a premium to its current valuation, but acquisitions are not always rational, so I can’t rule out the possibility. Still, the downside risk in this stock is much greater than the slim chance of a lucrative buyout.

CALD is a great example of the sector trap. When a high growth industry, like cloud computing, catches the market’s eye, the flood of investors sends all stocks higher, even those like CALD that can’t justify their valuations. Look for an even bigger drop in the future as the market value adjusts back to the reality of CALD’s fundamentals.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

The following article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted-In: Short Ideas Markets Trading Ideas

Most Popular 3 Reasons To Embrace The Double-Digit Drop In Exxon Mobil Earnings Scheduled For February 12, 2014 Will Creative Edge Nutrition Become The Jolly Green Giant Of Medical Marijuana? Whole Foods Market Earnings Preview: Double-Digit Revenue Growth Expected 5 Apple Headlines From Monday You Might Have Missed 3 Reasons To Trust Dividends More Than Analysts Related Articles (CALD + CRM) Danger Zone: Callidus Software (CALD) JMP Sees Salesforce Posting 'Blow-Out' Q4 Results Market Wrap For February 4: Investors And Traders Go Bargain Hunting UPDATE: Deutsche Bank Downgrades Salesforce.com on Near-Term Concerns Benzinga's Top Initiations UPDATE: Credit Suisse Initiates Coverage on Callidus Software Partner Network Around the Web, We're Loving... Create an Account With Options House and Get 150 Free Trades! Pope Francis Rips 'Trickle-Down' Economics Wynn, MGM, Other Casino Giants Vying For U.S. Turf What Should You Know About AMZN? View the discussion thread. Partner Network View upcoming Earnings, Ratings, Dividend and Economic Calendars.

No comments:

Post a Comment