The Fed on Wednesday is expected to cut Unemployment and Growth forecasts, while raising its Inflation forecasts as the group prepares to raise rates in 2015, keeping in-line with the expectations of consistent tapering of $10 billion per month.

For today though, the Street will be watching for the Fed to update its economic forecasts and policy guidance, offering a window for market participants to observe the key factors playing into the Central Banks' expected 2015 rate increase. The thesis going around the desks has been a delusion about the Fed seeking to carry out a planned agenda, as opposed to the private group being reactionary to the economic environment.

The current data and winter weather impact assurdely the group cautious.

The yield curve has been flattening and the inflection point is between the five and 10-year. Market makers Benzinga have spoken with in Chicago Fed Fund markets expect to see rates continue to drop. Over the past six months the 30- and 10-Year CMT have dropped, flattening the yield curve.

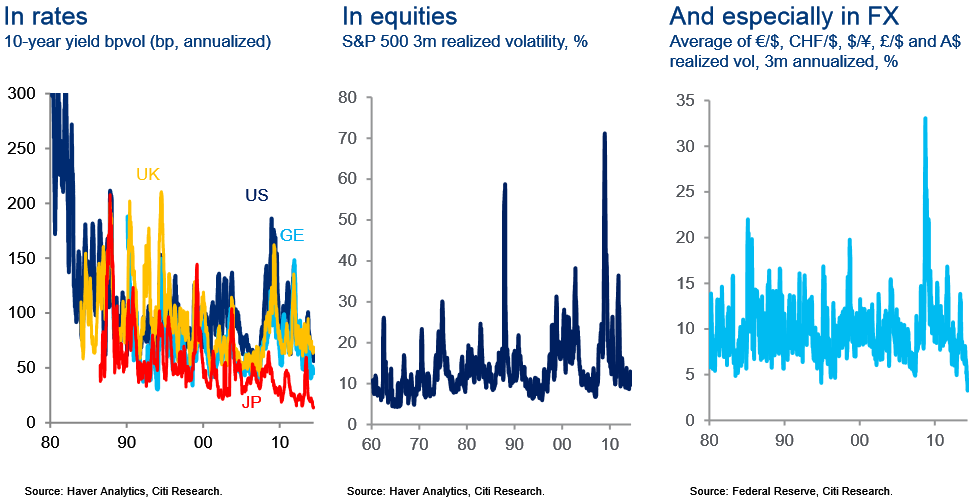

One problem out here has been a lower volatility environment constraining dealer profits, which has increased trading volumes. This has been happening across the fixed-income, equity and FX markets, as traders are trying to trade more in tighter ranges to maintain profitability.

One problem out here has been a lower volatility environment constraining dealer profits, which has increased trading volumes. This has been happening across the fixed-income, equity and FX markets, as traders are trying to trade more in tighter ranges to maintain profitability.

The remaining trade will be in the Credit Default Swap market, with the big money running into alternative assets given the dynamics just stated with bond, equity, and FX markets and any remaining capital being used to fund the high-rate of M&A activity.

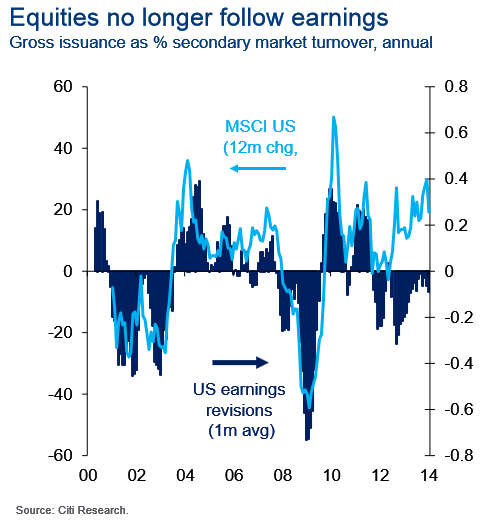

As even in the most basic equity market, valuations are not following earnings, according to a note released Tuesday by Citigroup’s Matt King.

North American High Yield and Emerging market CDS indexes have increased roughly two percent since March 2014, while European, Asian and Japanese CDS indexes have contracted, according to data from Markit. CDS indexes have also been the locale for volatility traders, which may explain why Hedge Funds are going all in with their bets as a means to save face from continued poor quarterly performance.

North American High Yield and Emerging market CDS indexes have increased roughly two percent since March 2014, while European, Asian and Japanese CDS indexes have contracted, according to data from Markit. CDS indexes have also been the locale for volatility traders, which may explain why Hedge Funds are going all in with their bets as a means to save face from continued poor quarterly performance.

Gauging a consensus view of the Fed commentary Wednesday afternoon will be futile if one only focuses on traditional assets. As highlighted previously, the big money that the Fed seems to believe will come back and fill the void left after taper is complete and has been benefiting from cheap money and volatility in alternative asset markets. The incentive to come back to traditional equity and bond markets does not exist and it won’t since the Fed has been so vocal about maintaining financial stability. According to comments from New York Federal Reserve President William Dudley in a speech last month, this is a topic the organization is so obsessed about that they have floated the idea of “gated” bond-fund holders along with a need to “blow bubbles because otherwise irrational investors get ‘carried away” and inevitably crash the markets.”

Posted-In: Eurozone Rumors Futures Forex Federal Reserve Markets

© 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Most Popular Trulia Rumored To Acquire Move Why 'How To Train Your Dragon 2' Is Another DreamWorks Disappointment 5 Stocks To Consider During The 2014 World Cup UPDATE: Morgan Stanley Initiates Coverage On BlackBerry UPDATE: Morgan Stanley Reiterates On General Electric On News Of Siemens/MHI Offer Breakdown Of Amazon Phone Opportunity By SunTrust Related Articles () Fuel Cell Stocks Rally Amid Bullish Analyst Comments Benzinga's M&A Chatter for Wednesday June 18, 2014 Several Major Companies May Be Affected By Redskins Trademark Cancellation Jabil Moving Up On Top and Bottom Line Beats Red Hat Up 5% After Hours; Beats Q1 Street Views Analysts Battle Over Competing Bids For MICROS Around the Web, We're Loving... Abercrombie Stems Bleeding Sales in Key Brand A Pristine Trading Plan for Intra-Day Trading

No comments:

Post a Comment